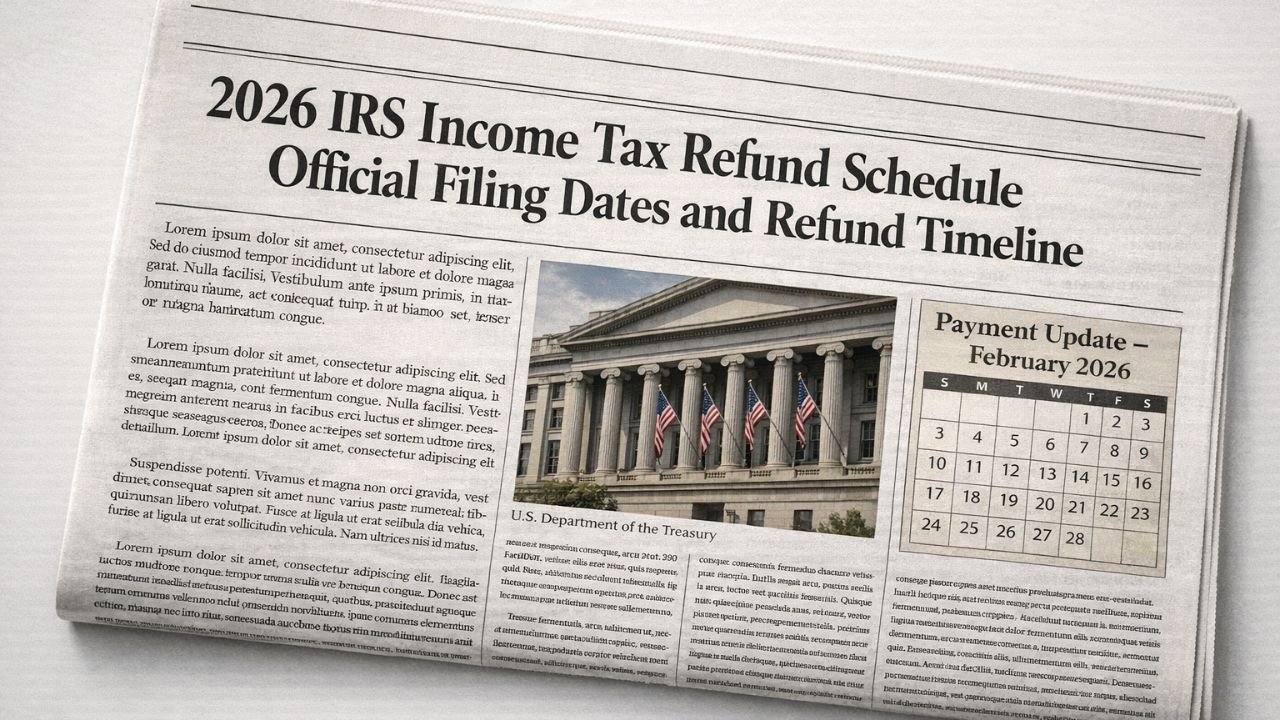

IRS Tax Refund Schedule Explained: How It Works and When You May Receive Your Refund

Many taxpayers who have already filed their 2025 income tax returns are now waiting for their refunds and wondering when the money will arrive. A tax refund can play an important role in a household budget. Some families use it to catch up on bills, pay down credit cards, or add to savings. Because the … Read more