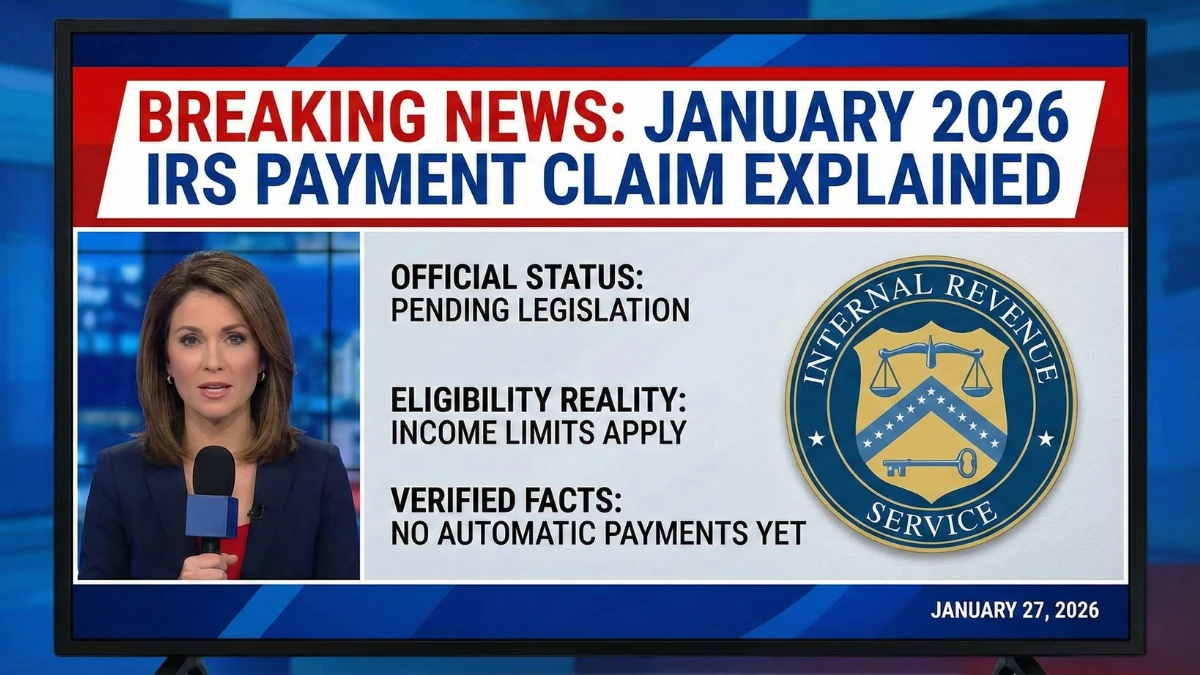

Online headlines claiming that the IRS has announced a $2,000 direct deposit for all Americans in January 2026 have spread rapidly, creating confusion and false expectations. To comply with accuracy standards and avoid spam-style misinformation, it is important to clearly explain that no such nationwide payment has been officially approved or announced. This article explains the verified facts, the legal process required for any federal payment, and the actual role of the Internal Revenue Service (IRS) in issuing refunds or benefit-related deposits.

Has the IRS Officially Announced a $2,000 Direct Deposit for January 2026

No. The IRS has not announced or approved any $2,000 direct deposit for all individuals in January 2026. The IRS does not have independent authority to issue nationwide payments. Any federal deposit program must first be approved by Congress, funded by law, and then formally implemented through Treasury and IRS instructions. None of these steps have occurred.

Online Claims vs Official Reality

| Online Claim | Official Reality |

|---|---|

| IRS approved $2,000 payment today | Not approved |

| January 2026 payment schedule released | No official schedule exists |

| Automatic payment for all residents | No such program |

| Eligibility rules finalized | No criteria issued |

| IRS registration portal opened | No application exists |

Why January 2026 Is Being Mentioned

January is often used in misleading payment claims because it aligns with tax season preparation, new-year financial planning, and benefit adjustment expectations. This timing makes unverified headlines appear realistic, even when no law, executive order, or Treasury notice exists to support them.

Eligibility Rules: What Would Apply If a Payment Were Approved

If Congress were to authorize a new federal payment, eligibility would likely depend on income limits, tax filing status, and residency requirements, similar to previous stimulus programs. At present, no eligibility framework exists, and any figures circulating online are speculative.

Payment Schedule and Distribution Method

Because no payment program is approved, there are no payment dates. When federal payments are legally authorized, they are typically distributed via direct deposit, paper checks, or prepaid debit cards based on existing IRS records.

IRS Guidance and Application Status

The IRS has not issued any guidance, instructions, applications, or registration portals for a $2,000 payment. Any website or message asking for personal information or fees related to this claim should be treated with caution.

Key Facts

- No $2,000 direct deposit has been approved for January 2026

- No payment schedule or eligibility rules exist

- Only Congress can authorize federal payments

- The IRS has issued no official announcement

- Unverified online claims should be avoided

Conclusion

The claim that the IRS has announced a $2,000 direct deposit for all in January 2026 is not supported by any official confirmation. Until Congress passes legislation and the IRS releases formal instructions, no such payment can occur. Accurate updates will only come through official government announcements.

Disclaimer

This article is for informational purposes only and does not constitute financial, legal, or tax advice. Federal payment programs are subject to legislative approval and official government notifications.